One billion euros less in 2021: Solar cap destroys market for small-sized photovoltaic systems and solar energy storage in Germany

According to EUPD Research calculations, a dramatic decline of new photovoltaic installations is to be expected once the 52 GW solar cap has been reached. Associated discontinuation of feed-in tariffs prevents an economic operation of newly installed photovoltaic systems. While the coronavirus epidemic has not impacted the demand for small-sized photovoltaic installations or home storage yet, the solar cap may cause a lack of installations worth one billion euros in 2021.

Bonn. For weeks, fundamental constraints resulting from the coronavirus crisis have become significantly apparent in various survey results and economic data. So far, the pandemic has barely affected the photovoltaic (PV) demand. Actually, the market segment of small-sized PV installations up to 10 kWp (generally private homes) even grew by almost one quarter compared to the first quarter of previous year. In total, the PV market in the first months of the year is almost at the same level as previous-year period.

Because of the imminent cap for new solar roofs the rather positive development is threatened to come to a sudden end in only a few weeks’ time. According to a new study by Bonn-based market and economic research institute EUPD, a deep slump in PV demand of home owners amounting to 83% can be anticipated once the cap has been reached in summer. A massive decline in sales of solar energy storage solutions is also predicted.

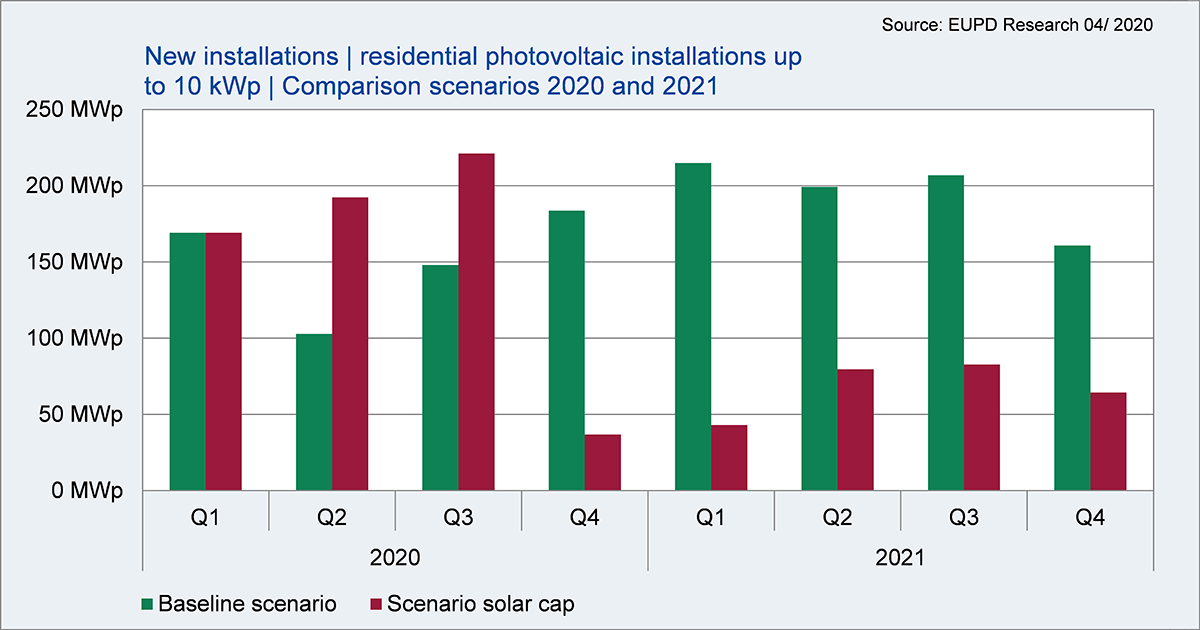

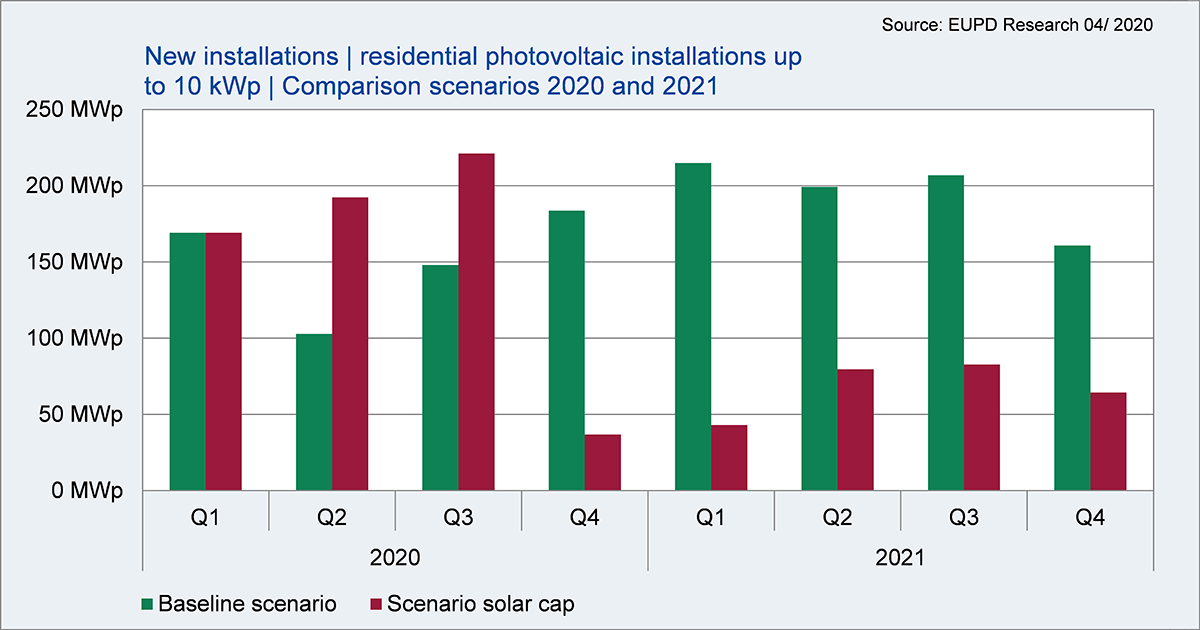

EUPD Research compares two possible trajectories for the market segment of small-sized PV systems: A baseline scenario with impacts of the coronavirus crisis as well as a scenario for the solar cap. An analysis of quarterly installation data show a dampening effect for the second and third quarter in 2020 associated with the economic crisis caused by the coronavirus. Sales are expected to recover starting in the first quarter 2021. In contrast, a significant anticipatory effect is expected for new small-sized solar installations if the solar cap continues to be in effect. This effect then comes to an abrupt end once the solar cap is reached in August 2020. Between the third and fourth quarter of 2020 a market decline is anticipated amounting to 83%.

Especially for private households, a photovoltaic system is often combined with the installation of other components such as energy storage or wall box to charge electric vehicles. Upon reaching the 52 GW solar cap and associated suspension of feed-in tariffs, an economic operation of photovoltaic installations is barely possible.

From a private household’s perspective two pathways are expected, should the solar cap continue to be in place: On the one hand, a majority of planned solar systems may not be built because of a lack of economic profitability. On the other hand, photovoltaic systems with smaller capacities are being realized, because higher self-consumption rates can be achieved with a reduced electricity output. It minimizes feeding of electricity into the grid to reduce losses for operators. For home battery solutions – as a complementing component for solar energy systems – this development means an even stronger slump in sales compared to photovoltaics installations.

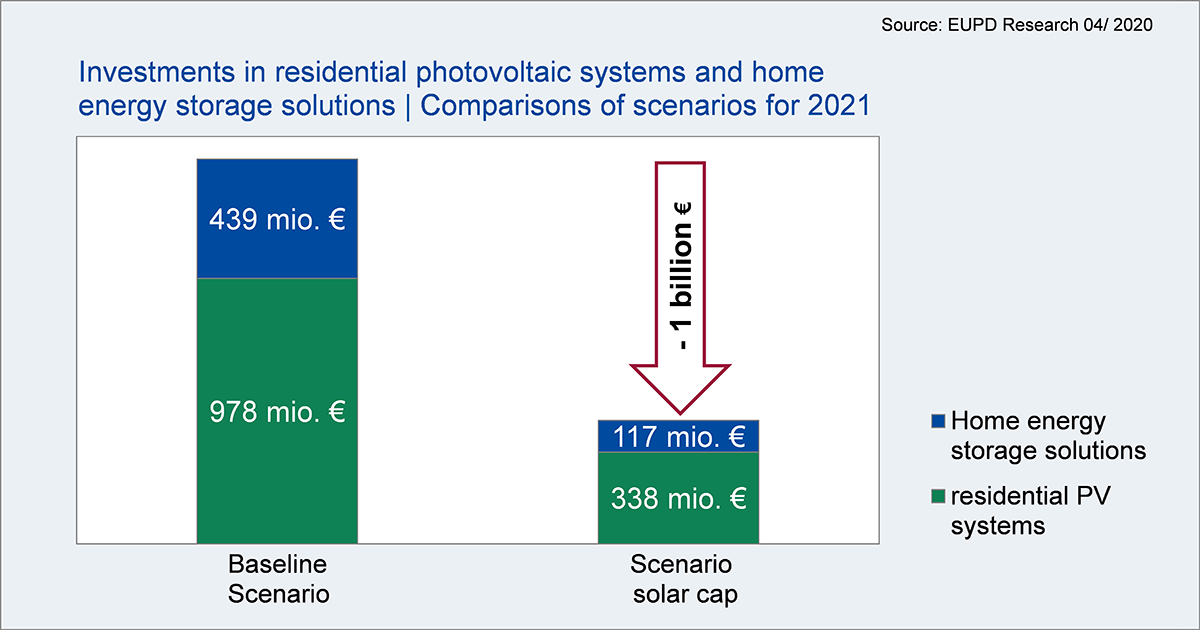

Due to the fact that 90% of home battery storage is often installed together with photovoltaic systems, the slump in sales of PV is particularly hard for home battery storage solutions. Moreover, the trend towards smaller photovoltaic installations negatively affects the demand for home battery storage products. While the number of newly installed, small-sized PV systems decline by two-thirds in the scenario with solar cap in comparison to the baseline scenario, the revenues for home battery storage in Germany even drops by 73%. Overall, EUPD Research anticipates a decline of investments in small-sized PV systems and home battery solutions amounting to one billion euros as longs as the solar cap is in effect. Sales drops of at least the same size are to be expected in the PV market segment of large commercial systems. Investors expect to do precise calculation with a “sharp pencil“.

“The solar cap causes a significant market slump for photovoltaics. With it, energy storage and electric mobility – both promising areas of the energy transition – are being equally slowed down.” comments Dr Martin Ammon, managing partner of EUPD Research.

Dr Andreas Piepenbrink, managing partner of E3/DC GmbH adds: “The solar cap threatens necessary investments in innovation and technology for storage and photovoltaic installations. Germany needs reliable parameters for self-consumption for new PV systems as well as for those installations phasing out of the feed-tariff after 20 years.”

Alexander Schütt, managing director of BayWa r.e. Solar Energy Systems GmbH, emphasizes: “EUPD Research’s numbers are very clear: If the solar cap remains in place although the federal government decided to abolish the cap in its Climate Package in September 2019, consequences would be fatal for the energy transition. Numerous medium-sized handicraft businesses would be directly threatened in their very existence. The cap must be removed as quickly as possible.”

“Besides my responsibility for the company, I am making an urgent plea to the government in my role as BSW (German Solar Association) board member. The 52 GW solar cap, which may be reached in summer, must immediately be abolished. We need support and rapid actions by the government without further delays. It is an important decision concerning industry, medium-sized businesses and the society as a whole. The government must act now”, states Peter Thiele, President SHARP Energy Solutions Europe.

The current EUPD Research market analysis is being supported by leading representatives of the solar and battery storage sector: BayWa r.e., E3/DC, Sharp and SOLARWATT.